puerto rico tax break

Written by Diane Kennedy CPA on June 4 2021. In 2019 the tax breaks were repackaged to attract finance tech and.

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

As of 2020 the tax rate is 115.

. HISTORY OF CRISIS. The zero tax rate covers both short-term and long-term capital gains. The government says Puerto Rico needs the.

Puerto Rico Offers Huge Tax Breaks and the IRS is Hot On the Trail. But still the lure of low-tax Puerto Rico has been good enough in the past to bring industries like pharmaceuticals to the island. They say you can form a Puerto Rican corporation hire employees in Puerto Rico and operate your business from your home in the US.

Commonwealth that answers to the IRS but it has quirky tax rules. To calculate your foreign tax credit you must reduce the income taxes paid to Puerto Rico by any amount of income taxes allocable to excluded Puerto Rican source income. The key to all this is that Puerto Rican income is exempt from US federal income tax.

Cryptocurrency traders hedge-fund managers and wealthy individuals have been exiting the mainland to Puerto Rico to avoid President Bidens proposed increases on capital-gains tax. Paul is not alone. When claiming a foreign tax credit you must complete Form 1116 Foreign Tax Credit.

10 of the tax collected goes to the municipality where the sale was executed there are 78 municipios - municipalities and 105 of. Two big tax breaks Puerto Rico is a US. 856 for more information about the foreign tax credit.

Act 22 Puerto Rico Individual Investors Act which introduced zero tax on capital gains and passive investment income like dividends. A growing number of wealthy outsiders are moving to Puerto Rico to take advantage of the islands tax breaks. You have to move to Puerto Rico to qualify.

Act 22 is for individuals. Relative to the Made-In-America tax break the Made-in-Puerto Rico tax break has significant advantages. The Puerto Rico Incentives only work if you live in Puerto Rico.

For the right business and if set up properly this can lead to significant tax savings. The incentive drew more interest after 2017 when Hurricane Maria decimated the island. In 2019 the Puerto Rican government combined these laws and renamed them Act 60.

Some offshore gurus claim that you can take advantage of Act 60 benefits while you live in the US. It confers a 100 tax holiday on passive income and capital gains for 20 years. And 2 the tax rate is for goods and services produced in PR and sold anywhere.

Territory also has crypto-friendly policies including huge tax breaks to those who spend. Read more about Puerto Rico taxes and how to qualify for these tax breaks in Part One of our Puerto Rico tax series. The IRS have begun auditing individuals who moved to Puerto Rico to take advantage of the tax incentives that began in 2012.

Beyond the fact that Puerto Rico offers a year-round tropical backdrop with picturesque beaches the US. Manufacturing companies to avoid corporate income taxes on profits made in US. Known as Act 60 previously Acts 20 and 22 Americans who move a qualifying business to Puerto Rico including becoming a Bona Fide resident and establishing an office in Puerto Rico will pay just 4 corporation tax and no tax on capital gains dividends interest and royalties.

Super-Rich Headed to Puerto Rico With an Eye on Tax Breaks Jun 8 2021 Blog Because Puerto Rico offers substantial tax advantages a new trend has begun. You have to pay yourself a normal base salary. Avoiding what he sees as unnecessarily high taxes in the Golden State in favor of Puerto Ricos considerable tax breaks.

1 the 4 corporate tax rate has existed for decades and lasts potentially decades into the future. Impuesto a las Ventas y Uso IVU is the combined sales and use tax applied to most sales in Puerto Rico. Puerto Ricos resident investor incentive commonly known as Act 22 lures wealthy individuals with the promise of legally skirting US.

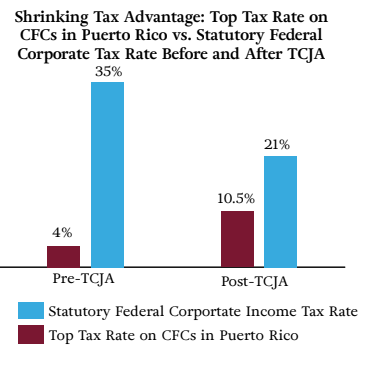

The Puerto Rico Sales and Use Tax SUT Spanish. But after the crash of 2008 the Puerto Rican economy never recovered so the government offered these incentives to attract investors and entrepreneurs. The Made-In-Puerto Rico tax break results in a total corporate tax rate of 4.

Still Puerto Rico hopes to lure American mainlanders with an income tax of only 4. Legally avoiding the 37 federal rate and the 133 California or other state rate sounds pretty good. That didnt matter before because Puerto Rican taxes were just as high as US taxes.

The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. Territories including Puerto Rico. One of those tax breaks enacted in 1976 allowed US.

Sales and Use Tax. The tax breaks fall under a law known as Act 60 a version of which was initially enacted by the Puerto Rico government under another name in 2012 as the island faced a looming economic collapse. Act 20 is for companies.

For years the wealthy have swarmed to Puerto Rico to profit off of tax exemptions that dont extend to native Puerto Ricans and while the island is still in an economic crisis there are concerns that. Salvador Casellas a federal judge and former treasury secretary of Puerto Rico was a leader in lobbying for manufacturing tax breaks in the 1970s during a crisis that echoes. Private wealth clients hedge fund managers and cryptocurrency traders fleeing to Puerto Rico for its huge tax breaksand to escape President Joe.

The incentives were intended to lure high net-worth individuals and businesses particularly crypto investors. Most residents pay no federal income tax. It gives owners of incented new Puerto Rican companies a 34 tax on dividended income.

Per capita income in 2020 was less than 33000 according to World Bank data.

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Us Tax Filing And Advantages For Americans Living In Puerto Rico

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Hate Taxes Move To Tax Free Puerto Rico Stay American Avoid Irs

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Luring Buyers With Tax Breaks The New York Times

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Faqs Tax Incentives And Moving To Puerto Rico

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

The Mckinsey Way To Save Puerto Rico

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union